You have probably heard about using put options to lock in a gain on a stock that has moved up in price. This is also one of the ways investors can lock in gains on a long call position. We received an email from a PowerOptions customer with the following details:

“Bought AUY Jan 20 2017, $1.50 CALL @ $1.19 a long time ago. Current price of the CALL is $2.85. I don’t own the stock itself. How do I lock in the profit but stay with the position, as I think that gold has a bright future? The only idea that crossed my mind is very simplistic: buy a protective PUT. For example, pay $1.41 for AUY Oct 21 2016 $5.50 PUT.”

Let’s break down this position: Yamana Gold Inc. (AUY) currently at $4.21

Own AUY 2017-JAN 1.50 call @ $1.19

Current Price = $2.85

Unrealized Gain = +$1.66, or +139%

Action:

Buy to Open AUY 2017-JAN @ $1.41

Total Invested into Position = $2.60 / contract ($1.19 + $1.41)

Maximum Risk = -$1.40, or -53.8%

Negative At Risk Amount = Guaranteed Return!

This adjustment creates an In-the-Money (ITM) Long Strangle Position. The investor would now own an ITM call and an ITM put against the stock. If the stock falls to $3.00 / share, the investor could Sell To Close the OCT 5.50 put for at least $2.50 (intrinsic value) and sell to close the 2017-JAN 1.50 call for at least $1.50.

The investor would take in at least $4.00 / contract, resulting in a minimum profit of $1.40 against an investment of $2.60. Minimum!

The Minimum return if AUY stays between the strike prices is $1.40, or 53.8%. The ITM Long Strangle also has further upside potential if AUY takes off over the next few months, AND the potential for additional profit if the stock falls in price, as well.

If AUY dropped to $0.01 per share on OCT expiration: The 2017-JAN 1.50 call would have a value close to $0.00 (maybe $0.01 to $0.03 of time value)

The OCT 5.50 put would have a minimum value of $5.49 (intrinsic value).

The investor could sell to close the OCT 5.50 put and realize a profit of $2.89 ($5.49 – $2.60 cost basis), or a 111% return against the cost basis of $2.60.

If AUY rocketed up to $9.00 per share on OCT expiration the put would be worthless but the 2017-JAN call would have a value of at least of $7.50, resulting in a profit of $4.90, or a 188% return against the $2.60 cost basis.

We are not projecting that AUY would drop to $0.01 / share or to $9.50 / share, but the new profit and loss of this adjustment would allow the investor to lock in a gain as well as potentially see larger profits if the stock swings in either direction. A ‘Bulletproof’ Strangle, if you will.

Are There Other Ways to Manage a Long Call that has Moved Up in Price?

Of course! Looking at this AUY example, an investor could choose to Roll Up the Call Leg:

Own AUY 2017-JAN 1.50 call @ $1.19

Current Price = $2.85

Realized Profit = +$1.66

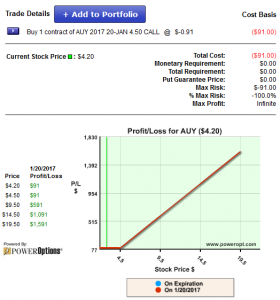

Buy to Open 2017-JAN 4.50 Call @ $0.75

Cost to Investor / Max. Risk = -$0.91

Negative Cost / Negative Risk = Guaranteed Return!

We take $0.75 from our realized profit to remain in a call position that has further upside gain. We keep $0.91 of profit in our account, which represents a return of 76% against our initial cost basis of $1.19. Even if AUY drops to $0.01 / share, we keep the $0.91 of profit. But, if AUY gaps up to higher prices we still keep the $0.91 profit and can close the $4.50 call for a higher price, increasing the return.

What are the outcomes:

1. If AUY remains below $4.50 at 2017-JAN expiration, the call expires. The investor would keep the $0.91 realized profit from the adjustment.

2. If AUY moves up above $4.50, the investor can realize MORE profit. The call will gain in value AND they would keep the initial $0.91 profit from the adjustment.

So, is creating the ITM Long Strangle a better approach for managing a Long Call that has an Unrealized Gain?

Well, that depends on your goals for the position, your outlook for the stock and the amount of capital you wish to invest in the position.

The ITM Long Strangle gives the investor a position that can realize higher profits if the stock moves drastically up or down…BUT, a higher outlay of capital is needed to create the strangle.

Rolling Up the Call locks in profit now, and leaves the upside open for further gains. However, if the stock falls drastically no further profits can be realized to the downside.

Can an investor combine the two: Rolling the Call and Then Creating the Strangle?

Absolutely! An investor can roll up the call first, then use the locked in profit to purchase an ITM put option. This would give the investor a position that could have higher profits in both directions, but at a much lower cost basis over just buying the ITM put and leaving the unrealized profit from the call on the table.

An investor could also lower their cost basis further by selling to close part of their position first (assuming they had multiple contracts), and THEN Rolling up the Call with the remaining contracts and buying the put option to create the ITM Strangle.

You always want to graph and simulate the potential adjustments before applying any adjustment to your account. The Profit and Loss / Custom Spread Tool on PowerOptions is a perfect tool to simulate adjustments and analyze the new risk-reward.

If you wished to see other potential ideas for Long Option adjustments, or how you might manage a Long Call or Long Put that is down in price and has an unrealized loss, check out our webinars page:

http://www.poweropt.com/webinars.asp

Click the Options Strategies tab, and then select to view ‘Managing Your Long Options Positions‘.

Are you currently not trading Long Calls or Long Puts?

No problem! There is a wealth of management ideas for Spread strategies, Naked Puts, Covered Calls and more available in our public archived webinars page. Enjoy, and let us know your thoughts!