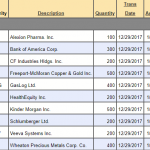

At the beginning of the year I wrote a Blog article about “A 2018 Market Forecast“. The basic forecast I setup was a rotation of sectors based on the economic and political environment of the time. About a dozen stocks were recommended in 5 sectors. Using those recommendations, I formed a model portfolio and have been tracking the results over the last 6 months. This article will review how that model stock portfolio has performed and offer some portfolio re-allocation ideas. The initial portfolio in January was:

There are 10 positions in the portfolio. $100,000 total was invested with about $10,000 in each position. During the last 6 months there have been some wild swings in the prices, but no changes were made to the portfolio. As an example, SLB was up as high as $79 and as low as $63. It is currently at $67 with little change from January. The concept of the portfolio was long-term and not to trade daily. Most of the positions in my actual account were done as married puts to insure the positions against some unforeseen event.

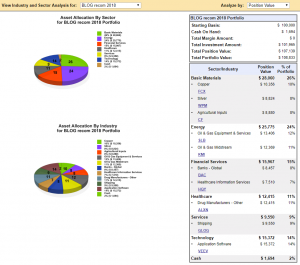

Four of the ten positions are profitable at the end of June and two of them very profitable. The 2 weakest position FCX and GLOG were purchased near their peaks, but I believe still have good prospects. Overall the portfolio is positive by about 9% and at one time was up about 12% in the last 6 months. The market sell-off over the last week in June took the edge off some of the best performers.

One of the reasons for doing a 6-month review is to evaluate the need for re-allocation of some positions. The original concept of portfolio re-allocation was originally applied to a portfolio that consisted of cash, bonds, and stocks. Since bonds and stocks are generally counter cyclical i.e. when bonds out perform stocks do not and visa versa, therefore there is an opportunity to sell the out performer and invest in the other for a cycle reversal. This same concept can be applied to sectors or a portfolio in general.

Since this is a “stock only” portfolio there are 2 streams of thought where portfolio re-allocation is concerned:

1. Sell the poorest performer and invest the proceeds in the best performer. For cyclical stocks this approach runs the risk of selling the poor performer just as they have bottomed and buying into an overpriced stock ready for a correction.

2. Sell the best performer believed to be over bought or extended and invest in the issue believed to be presently undervalued and about to move higher. This approach risks poor timing. The good performer may continue to advance, and the poor performer may start hitting new lows again.

Without a crystal ball, it’s a matter of judgement on the timing. In this case I’m siding with approach #2. The 2 stocks that advanced the most now represent a disproportionate amount of the portfolio. They have a value 50% more than the original $10,000 allocated. Therefore, perhaps the portfolio should be re-balanced by taking some profits in HQY, which also happens to look over extended and perhaps ready for some profit taking. And the proceeds from the HQY sale would be invested in the 3 stocks that have the most promise to advance FCX, KMI and GLOG, all three of which happen to be the poorest performers at this time.

They have a value 50% more than the original $10,000 allocated. Therefore, perhaps the portfolio should be re-balanced by taking some profits in HQY, which also happens to look over extended and perhaps ready for some profit taking. And the proceeds from the HQY sale would be invested in the 3 stocks that have the most promise to advance FCX, KMI and GLOG, all three of which happen to be the poorest performers at this time.

Note, seven out of the ten stocks in the portfolio have dividends. The effective cost per share of those stocks is lowered by the dividend. Dividends increased the total unrealized portfolio return about 1% in the first six months. Also note that the top 3 highest performing stocks had high growth rates but no dividend.

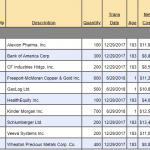

The sale of HQY and allocation of the sale proceeds left $1,694 in cash in the account. Adjustments were made to the original portfolio for the sale of 100 shares of HQY, dividends on 7 of the stocks, and the purchase of addition shares for FCX, KMI and GLOG. The resultant portfolio now is shown below:

With the changes suggested the new allocation by sector and industry will look like at the end of June: